Introduction

Cryptocurrencies have gained popularity due to their potential for high returns, but they also come with significant risks. This makes it important for potential investors to conduct thorough analysis before investing. Understanding the key factors that impact a cryptocurrency’s price and demand is crucial for making informed decisions and minimizing risks. Crypto Space Regulatory Updates are also important to consider, as they can have a significant impact on the market.

Key points to consider in analyzing cryptocurrency market trends include:

- Volatility: Cryptocurrencies are known for their volatile nature, and their values can fluctuate significantly within a short time. This can present both opportunities and risks for investors.

- Market Demand: Understanding the demand for a particular cryptocurrency is crucial in analyzing its potential for growth. Factors such as adoption by businesses and consumers, as well as technological advancements, can impact market demand.

- Market Capitalization: The growth of Bitcoin market capitalization is an important trend to monitor, as it reflects the overall value and significance of the cryptocurrency market.

- Financial Institutions: The interest from financial institutions in cryptocurrencies is another trend to be aware of. This can signal growing acceptance and integration of cryptocurrencies into the traditional financial system.

As we delve into the various aspects of market analysis, it becomes evident that staying informed about regulatory concerns and market volatility is crucial. The benefits and risks of Bitcoin must also be carefully considered before making investment decisions.

In conclusion, while the potential for high returns in the cryptocurrency market is appealing, it is essential to approach investments with caution and thorough analysis. By understanding the trends and factors that impact cryptocurrency prices, investors can make informed decisions and minimize risks.

The Rise of Bitcoin and Cryptocurrencies

The rise of Bitcoin and other cryptocurrencies has been a significant trend in the financial industry. As the first decentralized digital currency, Bitcoin has paved the way for the development of numerous other cryptocurrencies. This section will explore the key factors contributing to the rise of cryptocurrencies and how fundamental analysis plays a crucial role in understanding their value.

Factors Contributing to the Rise of Cryptocurrencies

- Innovation: The development of blockchain technology has revolutionized the financial landscape, providing a secure and transparent platform for digital transactions.

- Decentralization: Cryptocurrencies operate independently of central banks and governments, offering users greater control over their assets.

- Global Adoption: The increasing acceptance of cryptocurrencies as a legitimate form of payment has led to widespread adoption across various industries.

- Investor Interest: The potential for high returns has attracted a significant influx of investors into the cryptocurrency market.

Role of Fundamental Analysis

Fundamental analysis is one of the primary methods of analyzing cryptocurrencies. It involves examining the underlying factors that contribute to a cryptocurrency’s value, such as:

- White Paper: A cryptocurrency’s white paper outlines its technology, purpose, and potential applications.

- Team Behind the Project: The expertise and experience of the development team can significantly impact the success of a cryptocurrency.

- Leadership: Strong leadership and vision are essential for driving the growth and adoption of a cryptocurrency.

- Use Case: Understanding the practical applications and utility of a cryptocurrency is crucial for evaluating its long-term value.

- Tokenomics: The distribution and supply dynamics of a cryptocurrency play a critical role in determining its scarcity and value.

This analysis helps determine if the asset is overvalued or undervalued and is essential for gaining a comprehensive understanding of the asset. Furthermore, it provides valuable insights into potential investment opportunities and risks within the cryptocurrency market.

As regulatory concerns continue to impact the crypto market, it is important to consider how regulation impacts on cryptocurrency can influence market trends and investor sentiment.

Benefits and Risks of Bitcoin

Bitcoin has gained widespread attention due to its potential benefits and associated risks. Here’s a closer look at some of the advantages and drawbacks of investing in Bitcoin:

Benefits:

-

Decentralization: One of the main advantages of Bitcoin is its decentralized nature, meaning it is not controlled by any single government or institution. This can offer a sense of security and independence for users.

-

Lower Transaction Fees: Bitcoin transactions typically come with lower fees compared to traditional financial systems, making it an attractive option for international transactions.

-

Potential for High Returns: The volatile nature of the cryptocurrency market means that there is potential for high returns on investment for early adopters.

-

Inflation Hedge: Many proponents of Bitcoin view it as a hedge against inflation, as there is a finite supply of 21 million coins.

Risks:

-

Market Volatility: The price of Bitcoin can be highly volatile, leading to rapid and unpredictable price movements that can result in significant losses for investors.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and changes in regulations could impact the value and legality of Bitcoin.

-

Security Concerns: While the blockchain technology underlying Bitcoin is secure, individual wallets and exchanges can be vulnerable to hacking and theft.

-

Lack of Consumer Protection: Unlike traditional banks, Bitcoin transactions are irreversible, and there are limited avenues for recourse in case of fraud or disputes.

While considering these benefits and risks, it’s important to note that making informed decisions about investing in Bitcoin requires a comprehensive understanding of market analysis. This includes fundamental analysis, which involves evaluating factors such as the technology behind Bitcoin and its potential applications.

On the other hand, technical analysis involves analyzing historical price and volume data to identify patterns and trends Investing in Bitcoin the Right way. This includes using price charts and patterns, volume, moving averages, oscillators, and market sentiment. Technical analysis can provide valuable insights into a cryptocurrency’s price movements but requires expertise in the field.

Regulatory Concerns and Market Volatility

As the cryptocurrency market continues to grow, regulatory concerns and market volatility have become significant factors for investors to consider. The rapid rise of Bitcoin and other cryptocurrencies has attracted the attention of regulators around the world, leading to new rules and restrictions being implemented in various countries.

Regulatory Concerns

- Increased Scrutiny: Regulatory bodies have been keeping a close eye on the cryptocurrency space due to concerns about money laundering, fraud, and market manipulation.

- Global Impact: The regulatory landscape varies significantly from country to country, creating a complex and challenging environment for investors and businesses operating in the cryptocurrency sector.

Market Volatility

- High Price Fluctuations: Cryptocurrencies are known for their extreme price fluctuations, which can be attributed to various factors such as market sentiment, technological advancements, and regulatory announcements.

- Impact on Investment Decisions: The volatile nature of the cryptocurrency market makes it essential for investors to carefully analyze market trends and make informed decisions.

The use of technical analysis in predicting market trends and prices can be particularly useful in navigating through regulatory concerns and market volatility. By understanding the complex algorithms and charts used in technical analysis, investors can gain insights into potential price movements and make informed investment decisions.

Furthermore, advancements in AI and machine learning have made technical analysis more accessible to casual investors. The automation of technical analysis processes allows for a more efficient and accurate interpretation of market data, providing valuable insights into potential risks and rewards associated with investing in cryptocurrencies.

Incorporating both technical analysis and fundamental analysis can provide a well-rounded view of a cryptocurrency’s potential. While fundamental analysis focuses on evaluating a cryptocurrency’s underlying value, technical analysis helps identify patterns and trends in price movements.

For more insights into predicting the next crypto bull run and understanding market analysis, be sure to check out the Next Bull Run Forecast article.

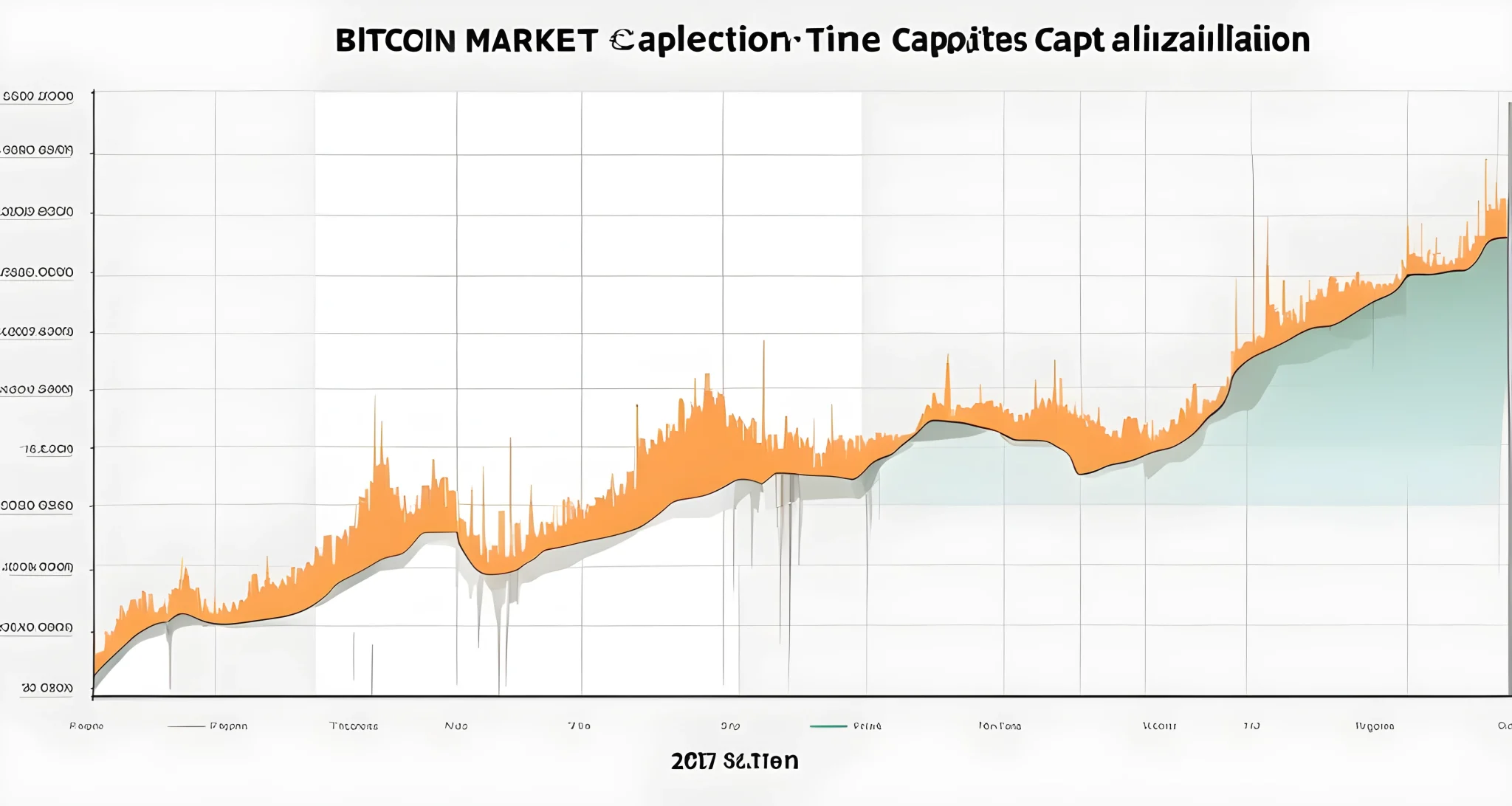

Growth of Bitcoin Market Capitalization

As the popularity of cryptocurrencies continues to rise, so does the market capitalization of Bitcoin. This section will explore the factors contributing to the growth of Bitcoin’s market capitalization and how it impacts the overall cryptocurrency market.

Key Factors in Technical Analysis

Some key factors in technical analysis include historical price and volume data, price charts and patterns, moving averages, oscillators, and market sentiment. These factors help analysts identify patterns and trends in a cryptocurrency’s price movements, which can be used to predict future prices and make informed investment decisions.

Historical Performance

- Bitcoin’s market capitalization has experienced significant growth since its inception in 2009.

- The price of Bitcoin has seen substantial fluctuations, contributing to both its growth and volatility.

- The increasing adoption of Bitcoin as a digital asset has also contributed to its rising market capitalization.

Impact on the Cryptocurrency Market

- The growing market capitalization of Bitcoin has influenced the overall valuation of the cryptocurrency market.

- As Bitcoin continues to dominate the market, its performance often sets the tone for other cryptocurrencies.

- Institutional interest in Bitcoin has further propelled its market capitalization, attracting more investors and increasing its value.

Regulatory Developments

- Regulatory concerns and market volatility Shaping the future of crypto with regulations have also played a significant role in shaping Bitcoin’s market capitalization.

- Positive regulatory developments have boosted investor confidence, leading to increased demand for Bitcoin and higher market capitalization.

- Conversely, negative regulatory news or uncertainty can have a detrimental impact on Bitcoin’s market capitalization.

Future Outlook

- The growth of Bitcoin’s market capitalization is expected to continue as more financial institutions and retail investors enter the cryptocurrency space.

- Ongoing advancements in technology and increasing mainstream adoption are likely to contribute to further growth in Bitcoin’s market capitalization.

- However, continued regulatory scrutiny and potential market corrections may also impact Bitcoin’s future market capitalization.

In conclusion, understanding the factors driving the growth of Bitcoin’s market capitalization is crucial for investors looking to navigate the dynamic cryptocurrency market. By analyzing historical performance, regulatory developments, and industry trends, individuals can make informed decisions when considering Bitcoin as part of their investment portfolio.

Interest from Financial Institutions

The increasing interest from financial institutions in cryptocurrencies has significantly contributed to their popularity and potential for investment. Here are some key points to consider:

-

Validation of Cryptocurrencies: The fact that established financial institutions are showing interest in cryptocurrencies is a strong validation of their potential as an investment asset. This validation can instill confidence in individual and institutional investors alike.

-

Market Integration: The entry of financial institutions into the cryptocurrency market is leading to increased integration of digital assets into traditional financial systems. This integration can potentially lead to greater liquidity and stability in the cryptocurrency market.

-

Diversification Opportunities: The interest from financial institutions is also creating new opportunities for diversification within investment portfolios. As traditional financial institutions start offering cryptocurrency-related products, investors have more options for diversifying their holdings.

-

Influence on Regulation: The involvement of financial institutions in the cryptocurrency market can also influence regulatory decisions. Their expertise and lobbying power can shape how governments and regulatory bodies approach the regulation of cryptocurrencies, potentially leading to more favorable outcomes for investors.

The growth of Bitcoin market capitalization and the interest from financial institutions are clear indicators of the evolving landscape of cryptocurrencies as an investment vehicle. However, it’s important to note that investors should also consider regulatory concerns and market volatility when analyzing cryptocurrencies. The future of NFTs in the crypto market is another trend that investors should keep an eye on, as it represents a new frontier in digital asset investment.

As the cryptocurrency market continues to mature, the interest and involvement of financial institutions will likely play a significant role in shaping its future trajectory. It’s essential for investors to stay informed about these developments as they navigate the complexities of the cryptocurrency landscape.

Conclusion

In conclusion, analyzing a cryptocurrency before investing is crucial for making informed decisions and minimizing risks. Fundamental analysis and technical analysis are two primary methods that can be used to gain insights into a cryptocurrency’s potential risks and rewards. Understanding the key factors that impact a cryptocurrency’s price and demand is essential for informed decision-making.

Fundamental Analysis

- Fundamental analysis involves evaluating a cryptocurrency’s underlying factors, such as its technology, team, and market demand, to determine its intrinsic value.

- This method helps investors understand the long-term viability and potential growth of a cryptocurrency.

Technical Analysis

- Technical analysis focuses on historical price patterns and trading volumes to forecast future price movements.

- This method helps traders identify entry and exit points based on price trends and market psychology.

Importance of Analysis

- Conducting thorough research and analysis can help investors identify potential risks and rewards associated with a particular cryptocurrency.

- This approach can also assist in determining the best investment strategy based on individual risk tolerance and financial goals.

Regulatory Concerns

- Regulatory concerns surrounding cryptocurrencies can significantly impact their market performance.

- It is important for investors to stay updated on the latest regulatory developments to make informed investment decisions.

Market Volatility

- The cryptocurrency market is known for its high volatility, which can lead to significant fluctuations in prices.

- Investors should be prepared for market volatility and consider diversifying their portfolios to mitigate risks.

Interest from Financial Institutions

- The increasing interest from financial institutions in cryptocurrencies signals a growing acceptance of digital assets in traditional finance.

- This trend could potentially lead to improved market stability and increased adoption of cryptocurrencies.

By considering these factors, investors can make more informed decisions when analyzing the risks and rewards associated with investing in cryptocurrencies. For further insights into altcoin investments, check out Altcoin returns and risks.

FAQ

Why is analyzing a cryptocurrency before investing important?

Analyzing a cryptocurrency before investing is crucial to make informed decisions and minimize risks. cryptocurrencies are known for their volatile nature, and their values can fluctuate significantly within a short time. by understanding the key factors that impact a cryptocurrency’s price and demand, you can gain insights into its potential risks and rewards, which can help you make more informed investment decisions.

What is fundamental analysis in cryptocurrency?

Fundamental analysis involves examining the underlying factors that contribute to a cryptocurrency’s value. this includes reviewing the white paper, understanding the team behind the project, learning about the leadership, and getting to know the use case and tokenomics of the crypto asset. the fundamental analysis helps to determine if the asset is overvalued or undervalued. it is essential to support fundamental analysis with technical analysis to gain a comprehensive understanding of the asset.

What is technical analysis in cryptocurrency?

Technical analysis involves analyzing historical price and volume data to identify patterns and trends. this includes using price charts and patterns, volume, moving averages, oscillators, and market sentiment. technical analysis can provide valuable insights into a cryptocurrency’s price movements but requires expertise in the field. it involves understanding the complex algorithms and charts used to analyze market trends and predict future prices.

How accessible is technical analysis for casual investors?

Technical analysis can be automated using ai and machine learning, making it more accessible to casual investors. this automation allows individuals to gain insights into market trends and price movements without the need for extensive expertise in the field. however, it is still important to have a basic understanding of technical analysis principles to interpret the data effectively.