Introduction

The debate between investing in Bitcoin and traditional investments, such as stocks, has garnered significant attention in recent years. The choice between the two ultimately depends on an individual’s risk tolerance, investment goals, and understanding of the respective markets.

Key Differences and Considerations

- Risk Tolerance: Bitcoin is known for its price volatility, making it a high-risk investment compared to more stable traditional assets like stocks.

- Investment Goals: Investors need to consider whether they are looking for long-term wealth preservation or short-term speculative gains.

- Understanding of Markets: Understanding the intricacies of cryptocurrency markets versus traditional financial markets is crucial for making informed investment decisions.

Market Trends and Adoption

- Bitcoin’s appeal lies in its potential for high returns due to its limited supply and growing demand from institutional investors and retail traders alike.

- Traditional investments, on the other hand, offer stability and a proven track record over time.

The Role of DeFi

- The rise of decentralized finance (DeFi) platforms on the Ethereum blockchain has introduced new investment opportunities that bridge the gap between traditional and digital assets. This article Ethereum DeFi rise explores how decentralized finance is shaping the future of investments.

As we delve deeper into the benefits, risks, market growth, and impact of Bitcoin on traditional investments, it becomes clear that there are various factors to consider when determining which option is better suited for individual investors. This article aims to provide an in-depth analysis to help readers make informed decisions about their investment strategies.

What is Bitcoin and How it Works

Bitcoin operates on a decentralized network using blockchain technology. This allows for secure and transparent peer-to-peer transactions without the need for intermediaries like banks. Here’s a closer look at what Bitcoin is and how it works:

Decentralized Network

- Bitcoin operates on a decentralized network, meaning that it is not controlled by any single entity or government.

- Instead, transactions are verified by network nodes through cryptography and recorded on a public ledger called the blockchain.

Blockchain Technology

- The blockchain is a distributed ledger that records all Bitcoin transactions.

- Each block in the chain contains a list of transactions and is cryptographically linked to the previous block, making it extremely secure and tamper-proof.

Secure and Transparent Transactions

- The use of blockchain technology ensures that Bitcoin transactions are secure and transparent.

- This eliminates the need for intermediaries like banks, reducing transaction costs and increasing efficiency.

Digital Currency

- Bitcoin is a digital currency that can be used to make purchases and payments online.

- It can also be stored in digital wallets and used for investment purposes.

Limited Supply and Scarcity

- One of the key features of Bitcoin is its limited supply, with only 21 million coins set to ever exist.

- This scarcity has contributed to its value as an investment asset.

Growing Acceptance

- Over the years, Bitcoin has gained acceptance in various industries and sectors.

- Many online retailers now accept Bitcoin as payment, and it has become a popular investment choice for individuals and institutions alike.

In summary, Bitcoin operates on a decentralized network using blockchain technology, allowing for secure and transparent peer-to-peer transactions without the need for intermediaries like banks. Its limited supply, scarcity, and growing acceptance in various industries have contributed to its popularity as a digital currency and potential investment asset.

Benefits of Bitcoin as an Investment

Bitcoin offers potential benefits as an investment, making it an attractive option for those looking to diversify their portfolios and protect against inflation. Here are some of the key benefits of investing in Bitcoin:

High Returns

- Bitcoin has shown the potential for high returns, with its value skyrocketing over the years. This has attracted many investors looking to capitalize on its upward trajectory and profit from its price appreciation.

Portfolio Diversification

- Investing in Bitcoin allows for diversification beyond traditional assets such as stocks and bonds. By adding Bitcoin to a portfolio, investors can potentially reduce overall risk and increase the potential for higher returns.

Protection Against Inflation

- With its limited supply and decentralized nature, Bitcoin is often seen as a hedge against inflation. As central banks continue to print fiat currency, the value of traditional currencies can decrease over time, while the finite supply of Bitcoin could potentially retain or increase in value.

While these potential benefits make Bitcoin an attractive investment option, it’s important to consider the risks and concerns associated with it as well.

- Price Volatility: The price of Bitcoin is known for its extreme volatility, which can lead to significant fluctuations in value over short periods of time.

- Regulatory Challenges: Government regulations and restrictions on cryptocurrency can impact the value and legality of investing in Bitcoin.

- Security Concerns: The risk of cyber attacks, hacking, and theft pose significant security concerns for Bitcoin investors.

- Market Manipulation: The unregulated nature of cryptocurrency markets leaves them vulnerable to manipulation by large players.

Despite these risks, the potential benefits of high returns, portfolio diversification, and protection against inflation make Bitcoin an appealing investment option for many. As the cryptocurrency market continues to evolve, it’s essential for investors to carefully consider both the benefits and risks before diving into the world of Bitcoin investments.

Risks and Concerns with Bitcoin

When considering Bitcoin as an investment, it’s important to be aware of the potential risks and concerns associated with this digital currency. While Bitcoin has gained popularity and value over the years, there are several factors that investors should take into account before diving in.

Volatility

- Bitcoin’s price volatility is one of the most significant concerns for potential investors. The value of Bitcoin can fluctuate dramatically within a short period, leading to potential significant gains or losses.

- Investors should be prepared for sudden price swings and understand the risks involved in such a volatile market.

Security

- Another concern is the security of Bitcoin transactions and storage. While Bitcoin transactions are secure, hackers have targeted cryptocurrency exchanges and wallets, resulting in substantial losses for investors.

- It’s essential for investors to prioritize secure storage methods and consider using reputable cryptocurrency platforms.

Regulatory Uncertainty

- The regulatory environment surrounding Bitcoin is another concern. The lack of clear regulations in many countries can create uncertainty for investors and businesses utilizing Bitcoin.

- Investors should stay informed about the evolving regulatory landscape and understand the potential impact on their investments.

Market Manipulation

- The potential for market manipulation in the cryptocurrency space is also a concern. Due to the relatively small market size compared to traditional investments, Bitcoin may be susceptible to manipulation by larger investors or institutions.

- Investors should be cautious and aware of potential manipulative practices that could impact the market.

Environmental Impact

- The environmental impact of Bitcoin mining is a growing concern. The energy-intensive process of mining Bitcoins has raised questions about its sustainability and environmental consequences.

- Investors should consider the long-term implications of Bitcoin’s environmental footprint.

As the market continues to evolve, understanding these risks and concerns is crucial for anyone considering investing in Bitcoin. While Bitcoin offers opportunities for growth, it’s essential to approach it with caution and awareness of its potential pitfalls.

For more insights into the impact of digital currencies on traditional finance, check out DeFi revolutionizing finance article.

Bitcoin’s Market Growth and Adoption

Bitcoin’s Market Growth and Adoption

As the first and most well-known cryptocurrency, Bitcoin has experienced significant market growth and adoption since its inception. Here are some key points to consider:

Market Growth

- Bitcoin’s market capitalization has grown exponentially over the years, reaching new highs and attracting more investors.

- The increasing use of Bitcoin as a store of value and investment alternative has contributed to its market growth.

- The limited supply of Bitcoin, with only 21 million coins available, has also driven up its value as demand continues to rise.

Adoption

- More companies and businesses are beginning to accept Bitcoin as a form of payment, further increasing its adoption.

- Institutional investors, like hedge funds and asset management firms, are starting to allocate a portion of their portfolios to Bitcoin, indicating a growing acceptance in traditional financial markets.

- Countries around the world are exploring the possibility of integrating Bitcoin into their financial systems, signaling a global adoption trend.

While Bitcoin’s market growth and adoption have been impressive, it’s important to note that it also comes with its own set of risks and concerns. The volatile nature of the cryptocurrency market and lack of regulatory oversight are just a few factors that investors should consider.

Bitcoin’s impact on traditional investments is also worth exploring, as it represents a new asset class that operates independently from traditional financial markets. This brings both opportunities and challenges for investors looking to diversify their portfolios.

In addition to Bitcoin, there are emerging potential altcoins that investors may want to consider for high growth potential. These alternative cryptocurrencies offer different features and use cases compared to Bitcoin, providing an opportunity for further diversification. For more information on emerging potential altcoins, check out Emerging potential altcoins.

Overall, Bitcoin’s market growth and adoption have been remarkable, but investors should carefully evaluate the risks and consider how it fits into their overall investment strategy. As the cryptocurrency landscape continues to evolve, staying informed about the latest developments is crucial for making informed investment decisions.

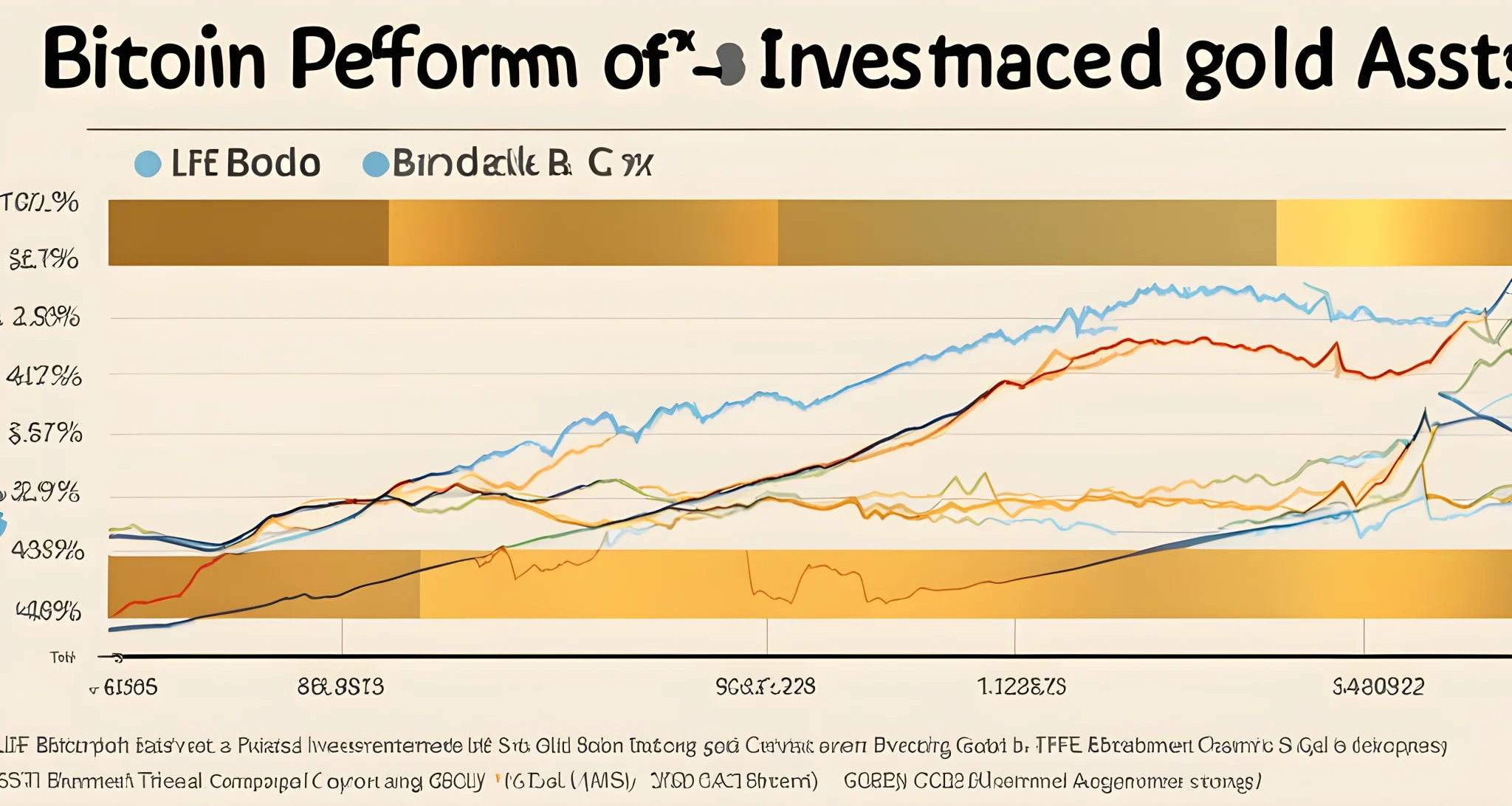

Bitcoin’s Impact on Traditional Investments

Bitcoin’s impact on traditional investments has been a topic of discussion among investors and financial experts. As a relatively new asset class, Bitcoin has brought about significant changes and considerations in the traditional investment landscape. Here are some key points to consider:

Understanding the Underlying Technology

- Investing in stocks requires a solid understanding of the underlying company and its long-term prospects.

- Cryptocurrency investments require staying updated with the latest news, understanding the underlying technology, and assessing the long-term potential of different cryptocurrencies.

Market Volatility

- Traditional investments such as stocks and bonds are known for their stability and relatively predictable market movements.

- Bitcoin, on the other hand, has been highly volatile, with prices experiencing rapid fluctuations due to various factors such as market sentiment, regulatory news, and technological developments.

Portfolio Diversification

- Traditional investors have traditionally relied on a mix of stocks, bonds, and other assets to build a diversified portfolio.

- Bitcoin offers a new opportunity for diversification, as it is not directly correlated with traditional asset classes. However, its high volatility also poses unique risks to consider.

Institutional Adoption

- While traditional investments have long been dominated by institutional investors such as banks and hedge funds, Bitcoin has seen increasing adoption by institutional players.

- The entry of institutions into the cryptocurrency space has brought about both validation and increased regulatory scrutiny.

Long-Term Potential

- When considering traditional investments, investors often focus on the long-term prospects of companies and industries.

- Similarly, assessing the long-term potential of Bitcoin involves understanding its use cases, technological developments, and adoption trends.

In conclusion, while Bitcoin has introduced new opportunities for investment and portfolio diversification, it also brings unique risks and considerations. Understanding the underlying technology, staying updated with market developments, and assessing the long-term potential are crucial for both traditional and cryptocurrency investments. As the cryptocurrency market continues to evolve, its impact on traditional investments will likely become more pronounced.

Conclusion

In conclusion, the rise of Bitcoin ETFs (Exchange-Traded Funds) has significantly impacted the cryptocurrency market by providing mainstream investors with easier access to Bitcoin. By offering a convenient and regulated investment vehicle, ETFs have removed the barriers to entry for those interested in adding Bitcoin to their investment portfolios. This development has further solidified Bitcoin’s position as a viable investment option in the traditional financial market.

Key Points to Consider:

- Accessibility: Bitcoin ETFs have made it easier for mainstream investors to gain exposure to the cryptocurrency market without directly owning and storing Bitcoin.

- Regulation: ETFs provide a regulated investment vehicle for those interested in adding Bitcoin to their investment portfolios, offering a level of security and oversight.

- Convenience: The convenience of investing in Bitcoin through ETFs has attracted a broader range of investors who may have been hesitant to navigate the complexities of cryptocurrency ownership.

Moreover, as Bitcoin continues to gain traction in the investment world, it is essential to recognize its impact on traditional investments. The growing acceptance and integration of Bitcoin into mainstream investment portfolios signify a shift in the financial landscape. This shift not only opens up new opportunities for investors but also raises questions about the future of traditional investments in the face of digital assets like Bitcoin.

As we continue to witness the evolution of the cryptocurrency market, it is crucial to stay informed about emerging trends and developments. One such trend is the rise of NFTs (Non-Fungible Tokens) within the crypto market. To delve deeper into this topic, check out our article on Future NFTs market crypto. Understanding the potential impact of NFTs on the crypto market can provide valuable insights for investors looking to diversify their portfolios.

In summary, while traditional investments have long been the cornerstone of financial strategies, the emergence and growing acceptance of Bitcoin as an investment option have introduced a new dynamic into the investment landscape. As we navigate this evolving terrain, staying informed and adaptable will be key in making informed investment decisions.

FAQ

What is the main difference between stocks and cryptocurrencies?

Stocks represent ownership in a company backed by assets and cash flow, while cryptocurrencies like bitcoin are not backed by physical assets and their value is primarily driven by market sentiment.

How are stocks and cryptocurrencies influenced by market sentiment and volatility?

Stocks are influenced by company performance and potential for growth, while cryptocurrencies are subject to volatile price fluctuations driven by market sentiment and technical factors such as regulatory developments.

What does investing in stocks require in terms of research and analysis?

Investing in stocks requires a solid understanding of the underlying company and its long-term prospects. it involves researching the company’s financials, management team, and industry trends.

How do bitcoin etfs make it easier for mainstream investors to invest?

The rise of bitcoin etfs has made it easier for mainstream investors to gain exposure to bitcoin without directly owning the cryptocurrency. these etfs trade on traditional stock exchanges and are regulated investment products.