Introduction

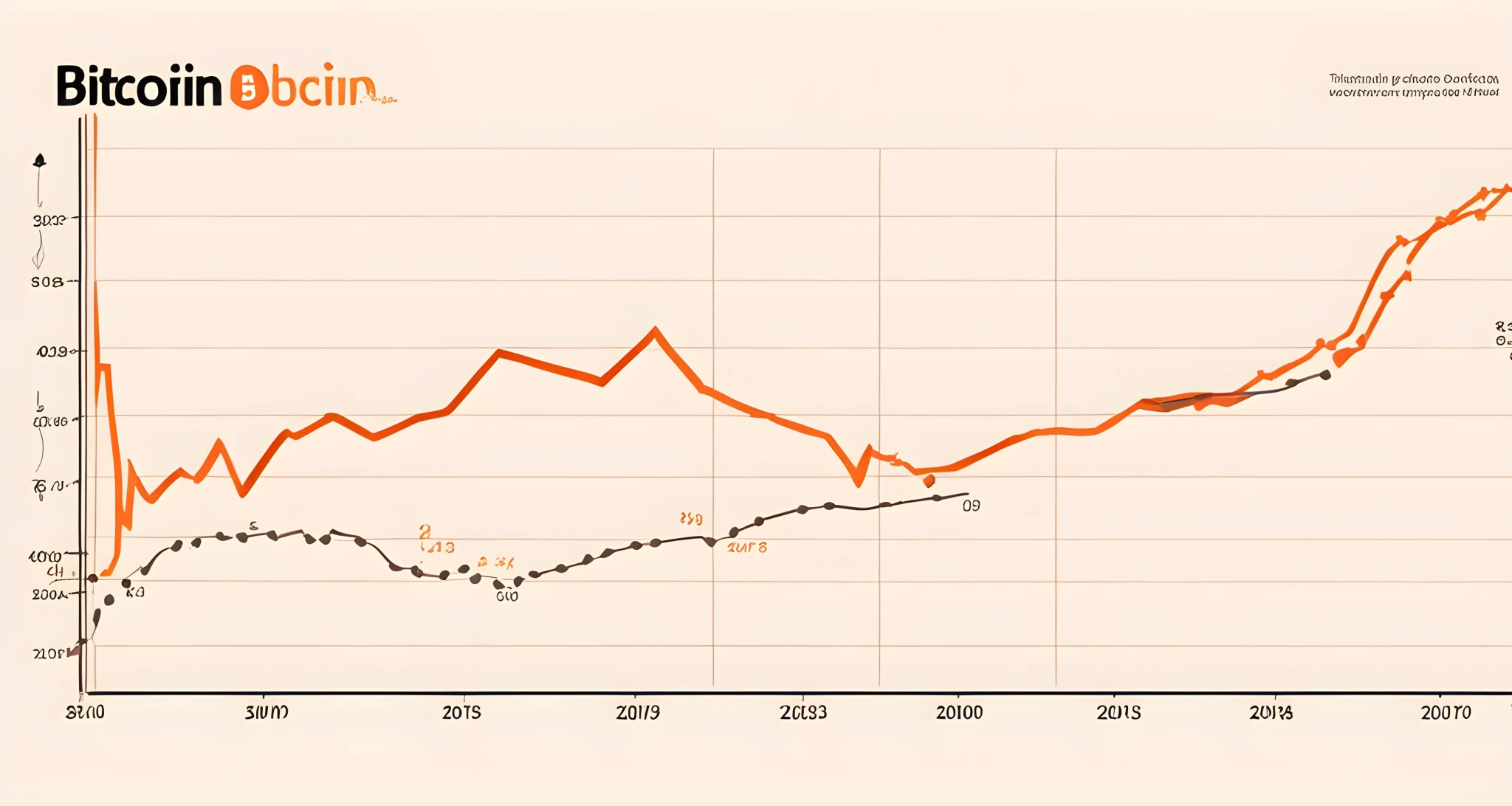

Bitcoin’s price predictions for 2024 have been particularly optimistic, driven by the upcoming halving and the potential approval of a spot bitcoin exchange-traded fund (ETF) in the United States. Industry experts and analysts have made various predictions, ranging from modest increases to astounding price surges.

Bitcoin’s price has always been a topic of keen interest for investors and enthusiasts alike. The year 2024 is especially significant due to the scheduled halving event, which historically has had a positive impact on Bitcoin’s price. Additionally, the potential approval of a spot bitcoin ETF in the United States could open up new avenues for investment and further drive up the price.

Market Sentiment in Crypto Trading

- The overall sentiment surrounding Bitcoin in the crypto market plays a crucial role in shaping its future price. According to the Market sentiment in crypto trading, positive sentiment can lead to increased demand and higher prices, while negative sentiment can have the opposite effect.

In the face of these developments, industry experts and analysts have put forth various predictions for Bitcoin’s price in 2024. Some anticipate modest increases, while others foresee astounding price surges that could potentially propel Bitcoin to new heights.

The upcoming halving event is expected to reduce the rate at which new Bitcoins are created, which historically has resulted in price increases due to decreased supply. Furthermore, the potential approval of a spot bitcoin ETF in the United States could bring about increased institutional interest and investment in Bitcoin, further boosting its price.

In conclusion, 2024 holds significant potential for Bitcoin’s price as it approaches an important halving event and the possibility of a spot bitcoin ETF approval. Industry experts and analysts have expressed varying degrees of optimism regarding Bitcoin’s future price, making it an exciting time for investors and enthusiasts alike.

Features and Benefits of Bitcoin

Bitcoin offers several key benefits that make it a popular and attractive option for investors and users alike. Here are some of the features and benefits of Bitcoin:

Decentralization

- Decentralization: Bitcoin operates on a decentralized network, meaning that it is not controlled by any single entity or government. This gives users greater control and autonomy over their own finances.

Security

- Security: The blockchain technology underlying Bitcoin ensures that transactions are secure and irreversible. This makes it a trusted option for peer-to-peer transactions.

Lower Transaction Fees

- Lower Transaction Fees: Compared to traditional financial systems, Bitcoin transactions typically come with lower fees. This makes it an efficient and cost-effective option for transferring funds.

Limited Supply

- Limited Supply: With a capped supply of 21 million coins, Bitcoin’s scarcity has contributed to its potential as a store of value, similar to precious metals like gold.

Increasing Adoption

- Increasing Adoption: As more businesses and individuals begin to accept and use Bitcoin, its potential as a medium of exchange continues to grow, increasing its utility and value.

These features and benefits contribute to the growing interest in Bitcoin as an investment and alternative financial system. Additionally, the potential for continued growth in the cryptocurrency market suggests that Bitcoin may continue to offer significant opportunities for investors Predicting Crypto Market.

Overall, Bitcoin’s unique features and benefits position it as an innovative and disruptive force in the financial world. As institutional interest in Bitcoin grows and technological advancements continue, it is likely that these benefits will continue to drive its adoption and use in the years to come.

Concerns about Bitcoin’s Stability

Bitcoin, while having gained significant attention and popularity, also faces a number of concerns regarding its stability. These concerns primarily stem from:

Price Volatility

- Bitcoin’s price volatility is a major concern for investors and users alike. The cryptocurrency has experienced significant price fluctuations, which can lead to uncertainty and risk for those involved in trading or using it for transactions.

Regulatory Uncertainty

- Regulatory uncertainty surrounding Bitcoin is another area of concern. As governments and financial institutions grapple with how to regulate cryptocurrencies, there is a lack of clarity on the legal status of Bitcoin in many jurisdictions. This creates uncertainty for users and businesses operating within these regions.

Vulnerability to Cyber Attacks

- The vulnerability to cyber attacks is a significant concern for Bitcoin. The decentralized nature of the cryptocurrency makes it a target for malicious actors seeking to exploit security weaknesses in the system.

Environmental Impact

- There are ongoing debates about the environmental impact of Bitcoin, particularly due to its energy-intensive mining process. The high energy consumption associated with Bitcoin mining has raised concerns about its sustainability and contribution to carbon emissions.

These concerns contribute to the overall perception of Bitcoin’s stability and reliability as a form of digital currency or investment vehicle. As such, potential investors and users should carefully consider these factors before engaging with Bitcoin.

In contrast, comparing Ethereum and Bitcoin reveals that Ethereum also faces similar concerns regarding its stability, regulatory status, and environmental impact. Both cryptocurrencies continue to be scrutinized for their viability as long-term investment options amidst these challenges.

Regulatory Status of Bitcoin

Bitcoin’s regulatory status varies widely across different jurisdictions. Some countries have embraced it as a legitimate form of payment and investment, while others have imposed restrictions or even outright bans on its use. This evolving regulatory landscape poses both opportunities and challenges for the cryptocurrency market.

Opportunities and Challenges

-

Opportunities:

– Embracing Bitcoin as a legitimate form of payment and investment can lead to increased adoption and use.

– Clarity in regulations can provide a sense of security for investors and businesses operating in the cryptocurrency market. -

Challenges:

– Inconsistent or restrictive regulations can hinder the growth and adoption of Bitcoin.

– Uncertainty about the legal status of Bitcoin can create barriers for businesses looking to enter the market.

Global Variances

The regulatory status of Bitcoin differs significantly from country to country.

- Some countries, such as El Salvador, have embraced Bitcoin as legal tender, while others, like China, have imposed strict bans on its use.

- In the United States, regulations vary by state, with some states embracing Bitcoin more than others.

Impact on Market

The evolving regulatory landscape has a direct impact on the growth and stability of the Bitcoin market.

- Clarity in regulations can attract institutional investors and mainstream adoption.

- Restrictive regulations can hinder innovation and limit access to the market for both individual investors and businesses.

For more information on the government’s role in crypto regulation, you can read Role of government in crypto.

In conclusion, the regulatory status of Bitcoin is a critical factor shaping its future. The varying approaches taken by different countries have significant implications for the growth and stability of the cryptocurrency market. As the regulatory landscape continues to evolve, it will be essential for investors and businesses to stay informed and adapt to changes in order to navigate these challenges effectively.

Growth of Bitcoin Market

The growth of the Bitcoin market is being driven by several key factors, contributing to its increasing popularity and adoption worldwide.

Increasing Public Awareness

- The rise in public awareness of Bitcoin has played a significant role in its market growth. As more people become familiar with the concept of cryptocurrency, the demand for Bitcoin continues to grow.

- Various media outlets, social media platforms, and educational resources have contributed to the dissemination of information about Bitcoin, leading to a broader understanding of its potential benefits and uses.

Growing Interest from Institutional and Retail Investors

- Institutional investors, such as hedge funds and asset management firms, have shown a growing interest in Bitcoin. This heightened interest is largely due to the potential for high returns and portfolio diversification that Bitcoin offers.

- Additionally, retail investors are increasingly drawn to Bitcoin as a hedge against inflation and economic instability, further driving market growth.

Development of Infrastructure and Services

- The development of infrastructure and services supporting the use and trading of Bitcoin has played a pivotal role in its market expansion.

- The emergence of cryptocurrency exchanges, digital wallets, and payment processors has made it easier for individuals and businesses to buy, sell, and transact with Bitcoin.

The interconnectedness of these factors has fueled the growth of the Bitcoin market. As a result, experts predict continued expansion in the coming years as more individuals and institutions recognize the value of Bitcoin as an investment and a decentralized form of currency.

To learn more about the broader impact of blockchain technology on financial markets, check out our article on Ethereum DeFi upsurge, which discusses the rise of decentralized finance on the Ethereum blockchain.

Institutional Interest in Bitcoin

In recent years, there has been a notable increase in institutional interest in Bitcoin. Major financial institutions and corporations are not only investing in the cryptocurrency but also offering related products and services, such as Traditional investments or Bitcoin?. This shift towards institutional involvement has played a significant role in bolstering the credibility and mainstream acceptance of Bitcoin.

Key Factors Driving Institutional Interest

Several key factors have contributed to the growing interest of institutions in Bitcoin:

- Potential for High Returns: Institutional investors are attracted to the potential for high returns offered by Bitcoin, especially in comparison to traditional investment options.

- Hedging Against Inflation: With growing concerns about inflation, institutions see Bitcoin as a hedge against the devaluation of fiat currencies.

- Diversification: Including Bitcoin in investment portfolios allows for diversification, spreading risk across different asset classes.

- Market Maturation: The increasing maturity of the Bitcoin market has made it more appealing to institutional players, with improved infrastructure and regulatory clarity.

Impact on Bitcoin’s Market Growth

The involvement of institutional investors has significantly contributed to the growth of the Bitcoin market:

- Increased Liquidity: Institutional participation has led to greater liquidity in the Bitcoin market, making it easier for large trades to be executed without causing significant price movements.

- Price Stability: Institutional interest has helped reduce volatility in Bitcoin prices, making it a more attractive asset for conservative investors.

- Broader Adoption: The entry of major financial institutions into the cryptocurrency space has accelerated broader adoption and acceptance of Bitcoin as a legitimate investment option.

Challenges and Considerations

While institutional interest brings numerous benefits to the Bitcoin market, there are also challenges and considerations to be mindful of:

- Regulatory Uncertainty: Despite growing institutional involvement, regulatory uncertainty remains a concern for many potential investors.

- Security and Custody Solutions: Institutions require robust security and custody solutions for holding and managing their Bitcoin investments, which presents unique challenges compared to traditional assets.

In conclusion, institutional interest in Bitcoin is a notable trend that has played a pivotal role in shaping the cryptocurrency’s market dynamics. As more institutions embrace and integrate Bitcoin into their investment strategies, its position as a legitimate asset class continues to strengthen.

Challenges of Using and Storing Bitcoin

Using and storing Bitcoin comes with its own set of challenges that need to be addressed for the widespread adoption and sustained growth of the Bitcoin ecosystem. Some of the key challenges include:

User Experience

- The user experience of dealing with Bitcoin can be complex and intimidating for newcomers, leading to a steep learning curve.

- Issues such as managing private keys, dealing with exchanges, and understanding transaction fees can be daunting for beginners.

Security Risks

- The decentralized nature of Bitcoin also means that security is a major concern.

- Users need to be vigilant about protecting their private keys from theft or loss, as well as being aware of potential scams and fraud in the ecosystem.

Regulatory Compliance

- The regulatory landscape surrounding Bitcoin is constantly evolving, and compliance requirements vary by jurisdiction.

- This can create uncertainty for businesses and individuals looking to use or invest in Bitcoin.

Reliable Infrastructure, Wallets, and Custody Solutions

- As the popularity of Bitcoin grows, there is a need for reliable infrastructure to support the increasing demand for transactions.

- Secure and user-friendly wallets and custody solutions are essential for protecting users’ funds and ensuring ease of use.

To address these challenges, there is ongoing work in the industry to improve the user experience, enhance security measures, and develop robust regulatory frameworks. Additionally, advancements in infrastructure, wallets, and custody solutions are being made to make it easier for users to store and use Bitcoin securely.

The future of NFTs in the crypto market Future crypto market NFTs also presents an interesting opportunity for addressing some of these challenges. NFTs have the potential to enhance the user experience by offering unique digital assets that can be securely stored on the blockchain. Additionally, innovative solutions using NFT technology may help improve security measures and provide new avenues for regulatory compliance within the crypto space.

FAQ

What are the key factors driving the optimistic price predictions for bitcoin in 2024?

The upcoming halving event in april 2024 and the potential approval of a spot bitcoin exchange-traded fund (etf) in the united states are the key factors contributing to the optimistic price predictions for bitcoin in 2024. these events are expected to reduce the supply of new bitcoin and make it easier for institutional investors to access the cryptocurrency.

What are some notable price predictions for bitcoin in 2024?

Some notable price predictions for bitcoin in 2024 are: mark mobius predicting $60,000 by the end of 2024, youwei yang predicting $75,000 by 2024, james butterfill predicting $80,000 with a 20% increase in assets under management, antoni trenchev and standard chartered both predicting $100,000, and carol alexander predicting $70,000 by the end of 2024 after the sec’s settlement with coinbase and binance.

How are the halving and etf approvals expected to impact the price of bitcoin in 2024?

The halving event in april 2024 is expected to reduce the block reward and slow down the supply of new bitcoin, which in turn is anticipated to contribute to a price increase. additionally, the approval of spot bitcoin etfs, allowing institutional investors to easily access the cryptocurrency, is also seen as a significant catalyst for the anticipated price surge.

What are some expert opinions on the potential price of bitcoin in 2024?

Industry experts and analysts have made various predictions for the price of bitcoin in 2024, ranging from modest increases to astounding price surges. opinions include mark mobius predicting $60,000, antoni trenchev and standard chartered both predicting $100,000, and carol alexander predicting $70,000, among others, based on different factors such as the halving event and etf approvals.