Introduction

Bitcoin Halving Effect on Prices

The Bitcoin halving is a significant event in the cryptocurrency ecosystem that directly influences the supply of new Bitcoins. It is a programmed change in the Bitcoin protocol that reduces the rate at which new Bitcoins are created by half. This reduction in supply, coupled with steady or increasing demand, particularly from institutional investors and retail adoption, can lead to increased price volatility and potentially a pre-halving price surge.

Impact of Bitcoin Halving

- The Bitcoin halving has historically been associated with significant price movements and increased market activity.

- The reduction in the rate of new Bitcoin creation can lead to supply shortages and increased competition among miners.

- This scarcity can drive up the value of existing Bitcoins, as the supply is limited and demand continues to grow.

Market Sentiment Analysis

- According to a Cryptocurrency sentiment analysis, market sentiment around Bitcoin halving events tends to be positive, with anticipation of potential price surges leading up to and following the event.

- Investors and traders closely monitor market sentiment indicators to gauge market expectations and potential price movements.

Price Volatility

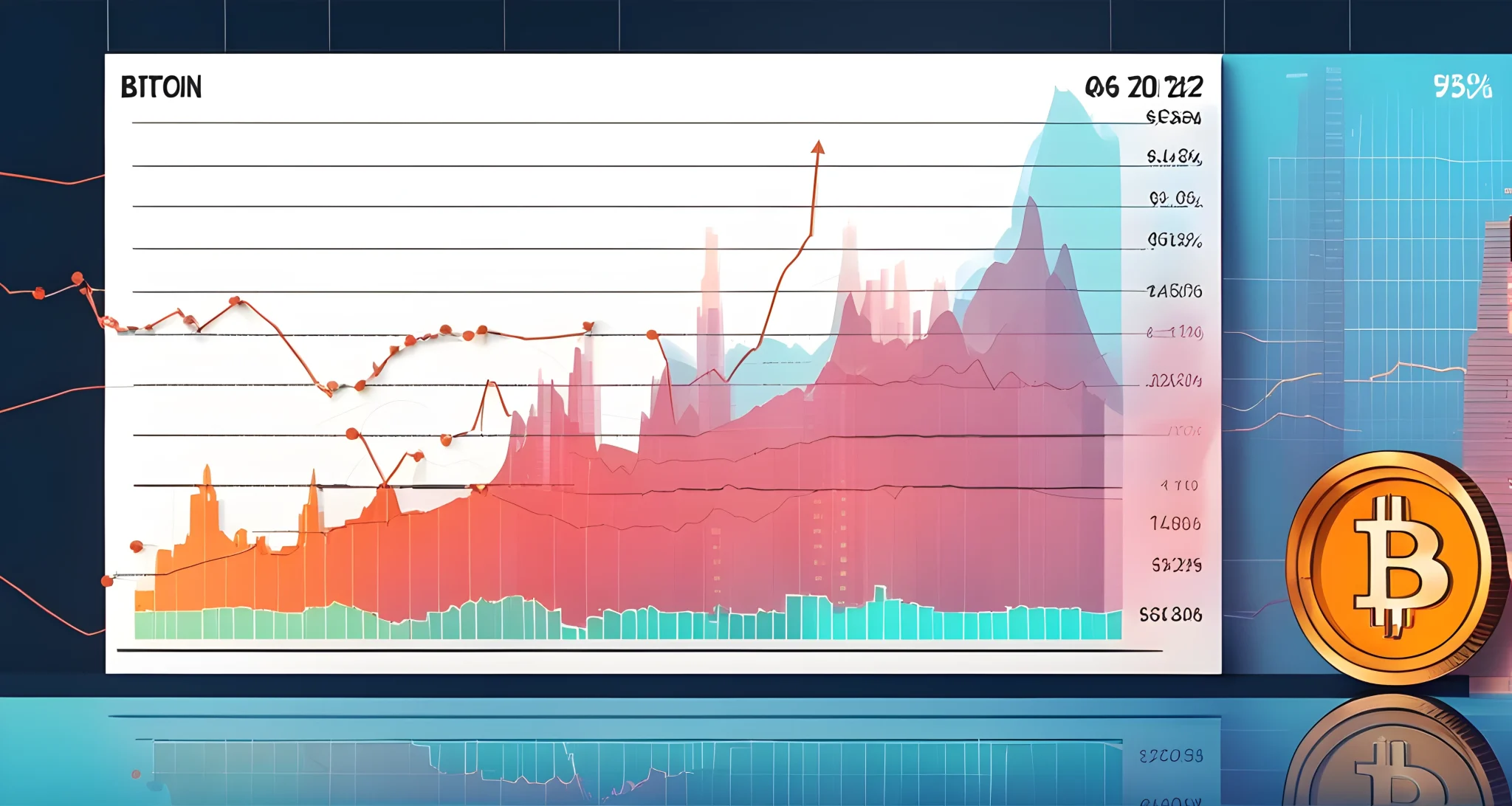

- The combination of reduced supply and increasing demand can lead to heightened price volatility.

- In the past, Bitcoin halving events have been followed by periods of both rapid price increases and sharp corrections.

Institutional Participation

- The growing interest from institutional investors in cryptocurrencies has added a new dynamic to Bitcoin halving events.

- Institutions bring significant capital and influence to the market, potentially amplifying both the pre-halving price surge and subsequent price movements.

Retail Adoption

- As more individuals and retail investors enter the cryptocurrency space, their participation can contribute to increased demand for Bitcoin.

- Retail adoption may contribute to sustained upward pressure on prices leading up to and following a Bitcoin halving event.

In conclusion, understanding the implications of the Bitcoin halving on prices requires an analysis of historical trends, market sentiment, and the interplay between supply and demand dynamics. As we delve deeper into this topic, we will explore how these factors have shaped past price movements after Bitcoin halving events and gather expert opinions on future price trends.

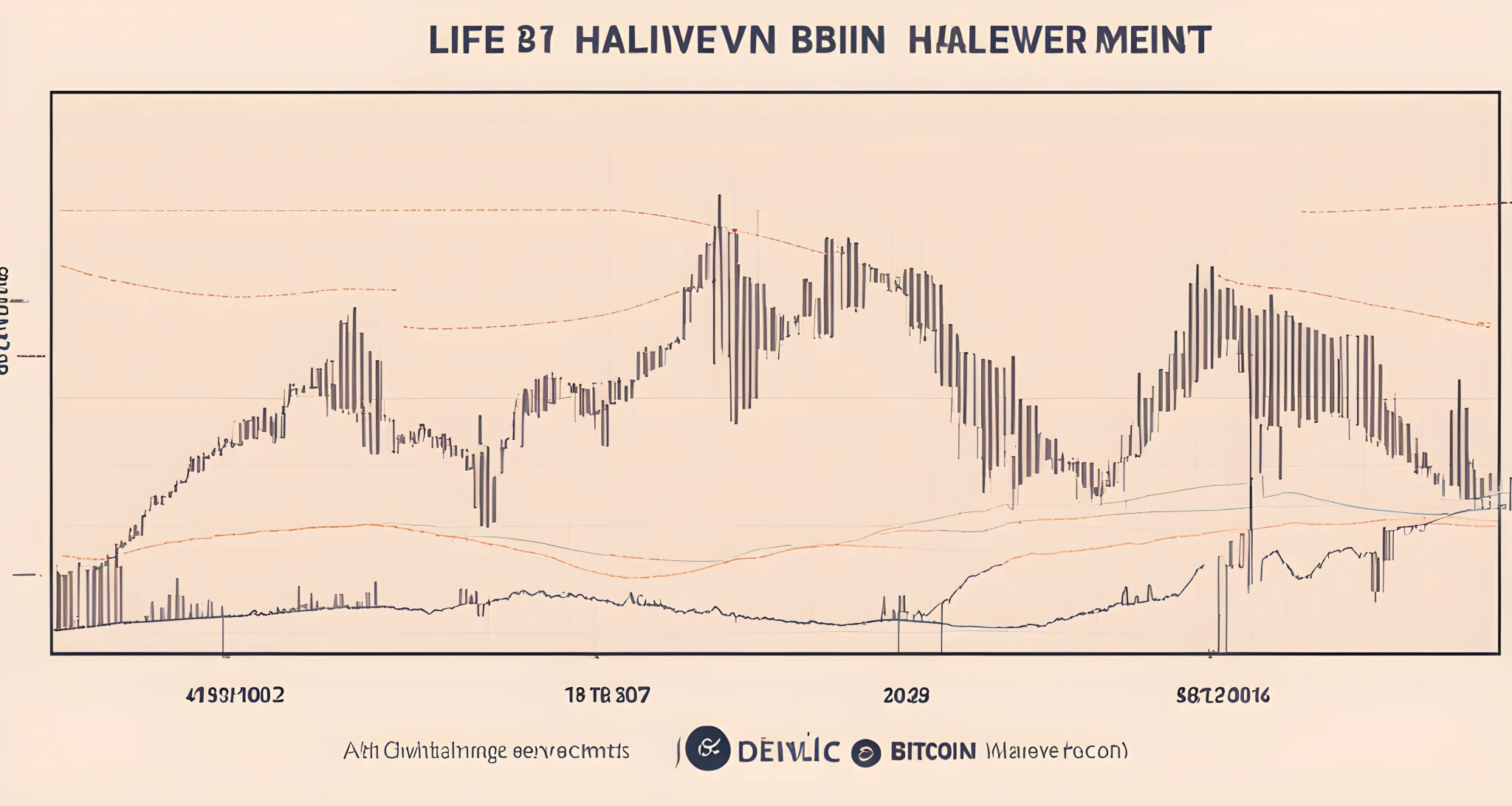

Understanding Bitcoin Halving

Bitcoin halving is a significant event in the world of cryptocurrencies that occurs approximately every four years. During this event, the rewards for Bitcoin miners are cut in half, reducing the rate at which new coins are created. This process is programmed into the Bitcoin protocol to limit the total supply of Bitcoin to 21 million coins, making it a deflationary asset.

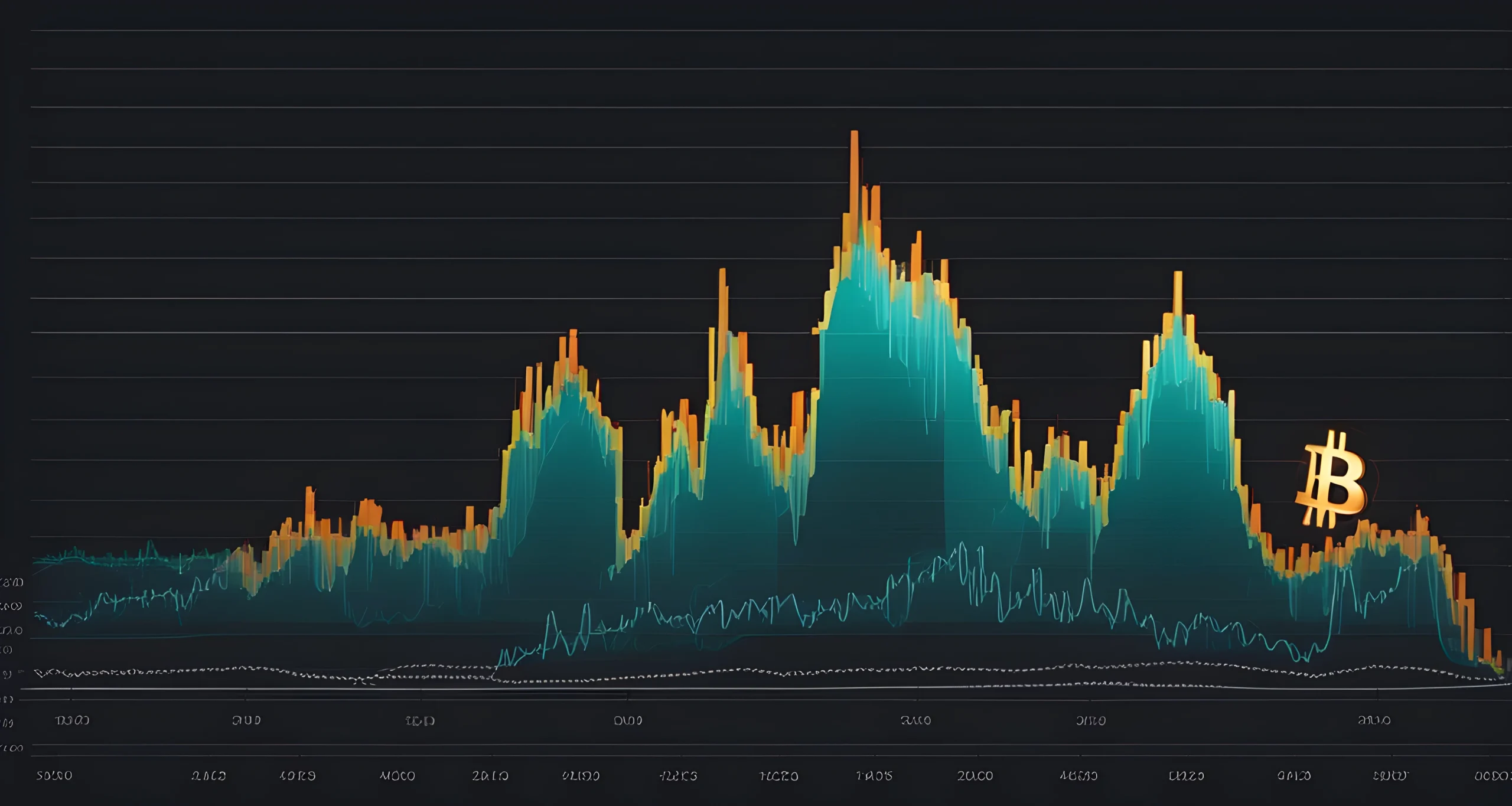

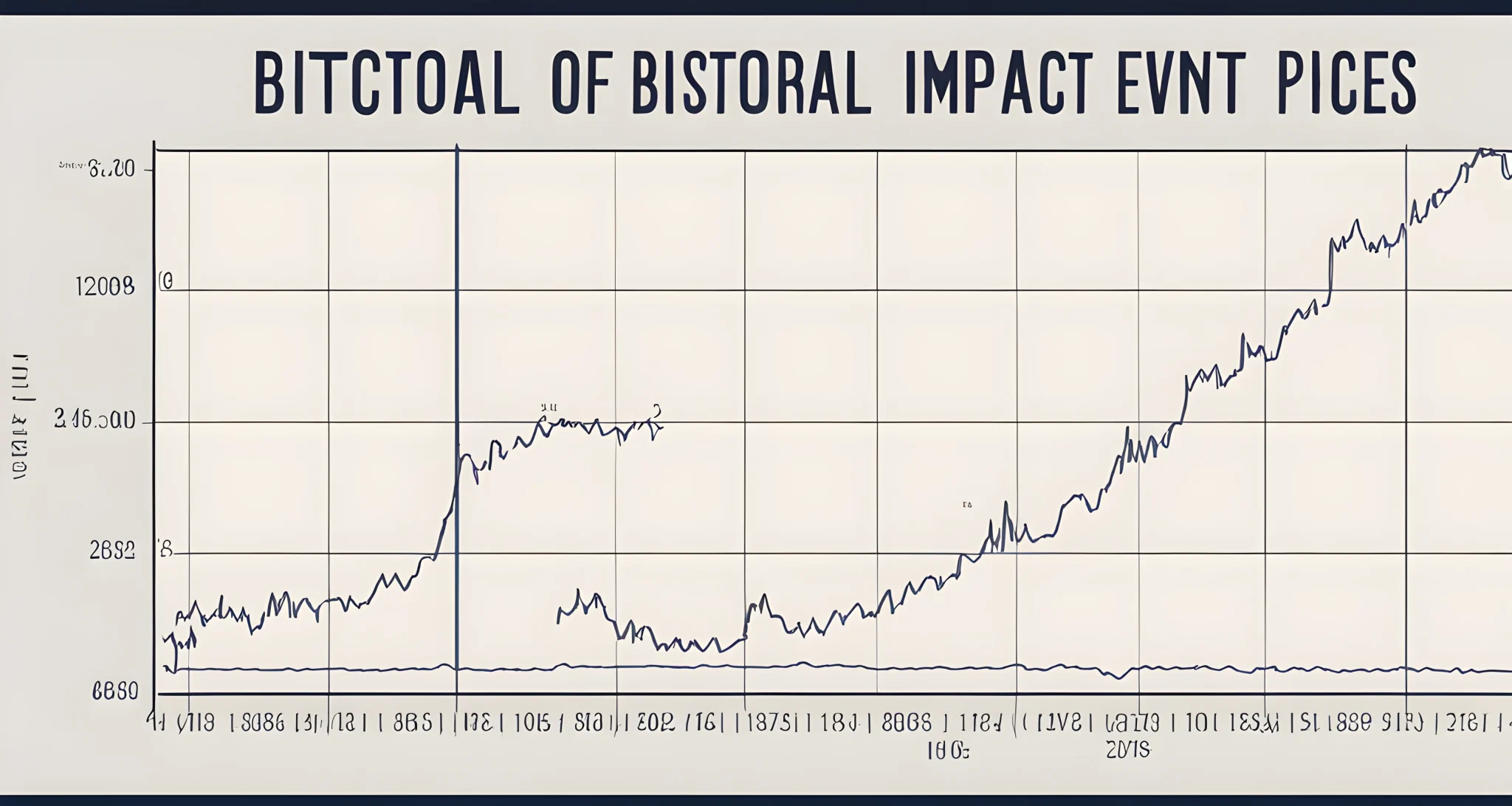

Historical Impact of Bitcoin Halving on Prices

Historically, the price of Bitcoin has shown a pattern of increasing in value following a halving event. After the 2012 halving, the price of Bitcoin rose from $12 in November 2012 to over $1,000 in November 2013. Similarly, after the 2016 halving, the price increased from $650 in July 2016 to approximately $2,500 in July 2017, and eventually reached a new all-time high of $19,700 in December 2017. The 2020 halving saw the price move upwards from around $8,000 in May 2020 to a new all-time high of over $69,000 in April 2021.

Factors Influencing Price Movements After Bitcoin Halving

Several factors contribute to the price movements following a Bitcoin halving:

- Supply and Demand: With the reduction in new supply, there is an increased scarcity of Bitcoin, driving up demand and ultimately prices.

- Market Sentiment: Positive market sentiment leading up to and following a halving can also contribute to price increases as investors anticipate potential gains.

- Miner Selling Pressure: After a halving event, miners may hold onto their newly acquired coins rather than selling them immediately, reducing selling pressure on the market.

Expert Opinions on Future Price Trends

Many experts believe that the historical pattern of price increases following a Bitcoin halving will continue in future cycles. This is supported by fundamental economic principles such as supply and demand dynamics. Additionally, with growing adoption and institutional interest in Bitcoin, there is potential for even more significant price movements in future halving cycles.

Furthermore, Profitable Trading Approaches can provide valuable insights into how traders can capitalize on these price movements and navigate the volatility that often accompanies Bitcoin halvings.

In conclusion, understanding Bitcoin halving and its historical impact on prices is crucial for anyone involved or interested in cryptocurrency markets. The predictable nature of Bitcoin’s monetary policy and its potential impact on prices make it an important consideration for long-term investors and traders alike. As we look towards future halving events, it’s essential to consider expert opinions and trading strategies to make informed decisions in this dynamic market.

Historical Impact of Bitcoin Halving on Prices

The halving event is closely watched by a range of network participants, including institutions, traders, and individual investors. The upcoming fourth halving is unique in the Bitcoin ecosystem, marked by a substantial increase in institutional engagement since the last halving occurred in 2020. This combined with the fact that the future market for crypto NFTs has been gaining traction, signals an evolving landscape for digital assets.

Price Movements Post-Halving

The historical impact of Bitcoin halving events on prices has been significant, with each halving event triggering a bull market. Here are some key insights into the price movements post-halving:

First Halving (2012):

- Bitcoin experienced a significant surge in price within a year of the first halving event.

- The price rose from around $12 to over $1,000.

Second Halving (2016):

- A similar pattern emerged after the second halving, with prices reaching an all-time high of nearly $20,000 in late 2017.

Third Halving (2020):

- The most recent halving also resulted in a notable price increase, as Bitcoin surged to over $60,000 in 2021.

Market Sentiment and Investor Behavior

The impact of Bitcoin halving events goes beyond just price movements. These events also influence market sentiment and investor behavior:

- Optimism: The anticipation of reduced supply often leads to increased optimism among investors and market participants.

- Long-Term Outlook: Many investors view Bitcoin halving events as a bullish signal for the long-term prospects of the cryptocurrency.

- Institutional Interest: The upcoming fourth halving is occurring at a time when institutional engagement in the crypto space is at an all-time high, adding further significance to its potential impact on prices.

Market Volatility and Trading Patterns

Bitcoin halving events are often accompanied by increased market volatility and distinct trading patterns:

- Volatility Peaks: Historical data shows that price volatility tends to peak around the time of halving events.

- Trading Patterns: Traders often adopt specific strategies around halvings, such as accumulating Bitcoin in anticipation of post-halving price increases or engaging in short-term speculative trading.

Key Takeaways for Investors

Understanding the historical impact of Bitcoin halving events on prices can provide valuable insights for investors:

Long-Term Investment Potential:

- Historical data suggests that long-term investment strategies have been favorable following previous halvings.

Volatility Management:

- Investors should be prepared for increased market volatility around these events and consider implementing risk management strategies.

Institutional Influence:

- The growing institutional interest in Bitcoin adds a new dimension to how halvings may impact prices, making it essential for investors to stay informed about industry developments.

As we approach the fourth Bitcoin halving, it’s evident that its historical impact on prices has been profound. With continued institutional engagement and evolving market dynamics, the upcoming event holds immense significance for the future price trajectory of Bitcoin.

Factors Influencing Price Movements After Bitcoin Halving

After a Bitcoin halving event, there are several factors that come into play to influence the price movements of the cryptocurrency. These factors are crucial for investors and traders to consider when strategizing their investment decisions. Here are some key factors that can influence the price movements after a Bitcoin halving:

-

Supply and demand dynamics: The most immediate impact of Bitcoin halving is the reduction in the rate at which new coins are created. This creates a supply shock, as the issuance of new Bitcoins is cut in half. With a reduced supply and constant or increasing demand, this can potentially lead to an increase in the price of Bitcoin.

-

Market sentiment and investor psychology: Investor sentiment plays a significant role in determining the price movements of Bitcoin post-halving. Positive sentiment, driven by optimism about the future prospects of Bitcoin, can lead to increased demand and subsequently drive up prices.

-

Institutional engagement: The upcoming fourth halving is unique in the Bitcoin ecosystem, marked by a substantial increase in institutional engagement since the last halving occurred in 2020. Institutional investors have a significant impact on price movements, and their growing interest in Bitcoin can potentially contribute to bullish price trends post-halving.

-

Mining economics: The profitability of Bitcoin mining is directly affected by the halving event. Miners play a vital role in securing and validating transactions on the Bitcoin network. A reduction in block rewards can lead to an exodus of less efficient miners, which can affect the network’s hash rate and subsequently impact price movements.

-

Regulatory developments: Regulatory changes and announcements can have a major impact on the cryptocurrency market. Positive regulatory developments can boost investor confidence and attract more institutional participation, potentially leading to upward price movements.

In light of these factors, it is essential for market participants to closely monitor these variables and stay informed about market developments to make well-informed investment decisions.

For more information on emerging opportunities within the cryptocurrency market, check out our article on Altcoins with high growth opportunities to explore potential investment options beyond Bitcoin.

Expert Opinions on Future Price Trends

The upcoming fourth halving event in the Bitcoin ecosystem has garnered significant attention from various network participants, including institutions, traders, and individual investors. The heightened institutional engagement since the last halving in 2020 has added an interesting dynamic to the discussion surrounding future price trends.

Institutional Engagement

- The increase in institutional engagement has been a notable shift since the last halving. Institutions are increasingly recognizing Bitcoin as a legitimate asset class, with many allocating a portion of their portfolios to digital assets. This trend has the potential to significantly impact the future price trend of Bitcoin.

- Experts believe that this institutional involvement could lead to a sustained increase in demand for Bitcoin, potentially driving prices higher in the long term. The influx of institutional capital is seen as a positive indicator for future price trends.

Trader Sentiment

- Traders are closely monitoring the halving event and its potential impact on price movements. The anticipation and speculation surrounding the halving have led to increased volatility in the market as traders adjust their positions based on perceived outcomes.

- Some experts believe that the heightened volatility leading up to and following the halving could present short-term trading opportunities for those who are able to navigate market fluctuations effectively.

Individual Investor Participation

- Individual investors continue to play a significant role in shaping the future price trends of Bitcoin. Retail interest in Bitcoin has remained strong, with many individuals viewing it as a hedge against traditional market uncertainties.

- While individual investors may not have the same level of influence as institutions, their collective participation can contribute to overall market sentiment and price movements.

Future Price Projections

- As with any investment asset, predicting future price trends for Bitcoin is inherently uncertain. However, many experts remain optimistic about the potential for continued growth in Bitcoin’s value over time.

- Some analysts project that the halving event could lead to a supply shock, resulting in a gradual increase in prices as demand outstrips the reduced incoming supply of new coins.

The upcoming fourth halving event presents an intriguing opportunity for market participants to assess and potentially capitalize on future price trends. As institutional engagement continues to grow and market dynamics evolve, it will be essential for investors and traders to stay informed and adapt their strategies accordingly.

For more information on the latest developments in blockchain technology and digital assets, check out our article on Ethereum DeFi elevation.

FAQ

What is the bitcoin halving?

The bitcoin halving is a programmed change in the bitcoin protocol that reduces the rate at which new bitcoins are created by half. this directly influences the supply of new bitcoins in the cryptocurrency ecosystem.

What impact does the bitcoin halving have on prices?

Historically, the price of bitcoin has shown a pattern of increasing in value following a halving event. after each halving, the price of bitcoin has experienced significant growth, often reaching new all-time highs.

Who watches the bitcoin halving closely?

The halving event is closely watched by a range of network participants, including institutions, traders, and individual investors. the upcoming fourth halving is unique in the bitcoin ecosystem, marked by a substantial increase in institutional engagement since the last halving occurred in 2020.

What is the significance of the 2020 halving event?

The 2020 halving saw the price of bitcoin move upwards from around $8,000 in may 2020 to a new all-time high of over $69,000 in april 2021, reflecting the impact of the halving on prices in the cryptocurrency market.