Introduction

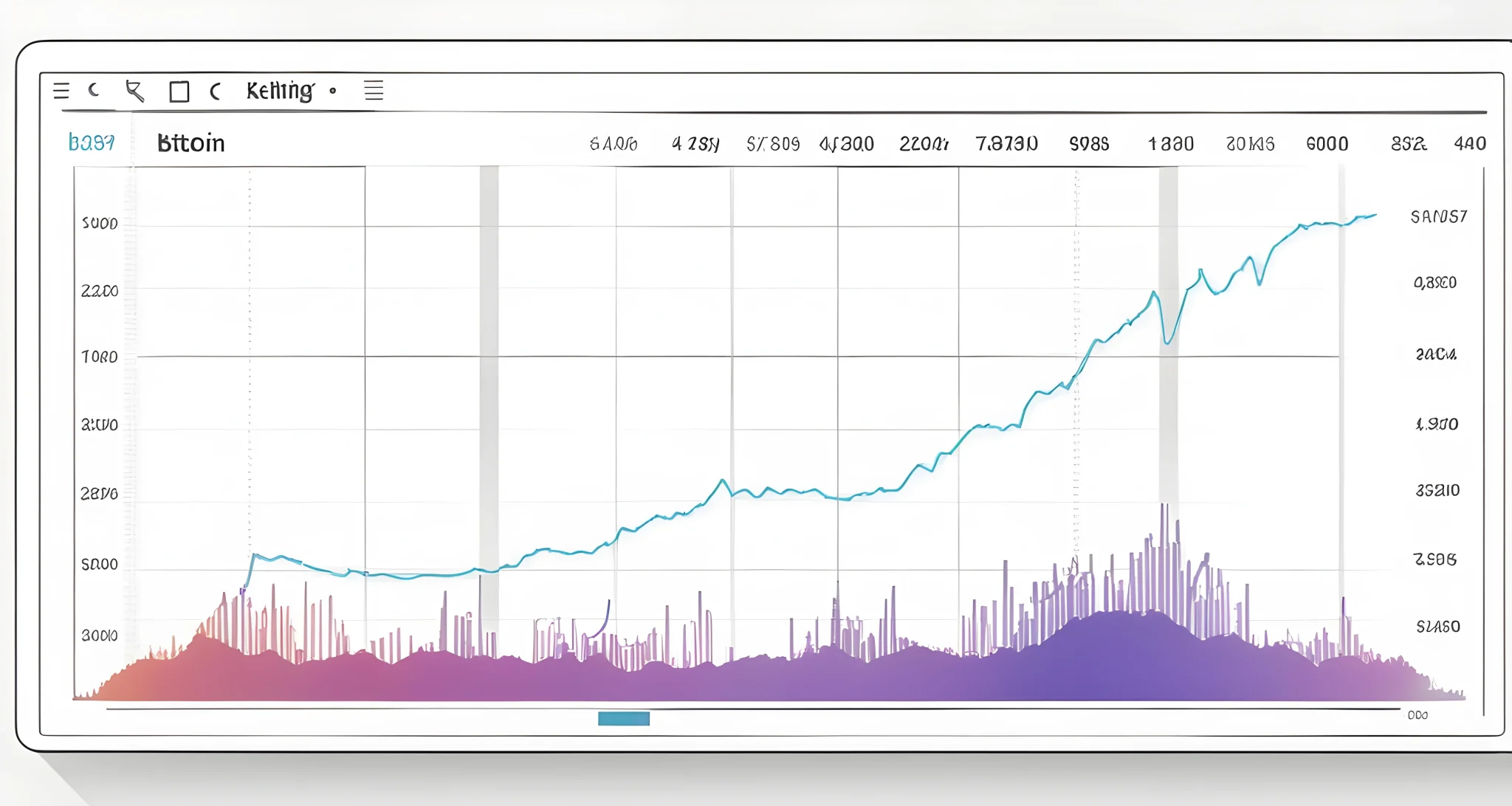

Cryptocurrencies have been a hot topic in recent years, with Bitcoin leading the charge as the most well-known digital currency. As the market for cryptocurrencies continues to grow, so does the need for regulatory clarity and stability. In 2024, the regulatory landscape for cryptocurrencies is expected to take center stage, with significant implications for the crypto space.

Regulatory Trends and Implications

The regulatory trends in 2024 are expected to shape up in various jurisdictions, driven by policy-making and regulatory bodies. This will have a significant impact on how cryptocurrencies are perceived and used in different parts of the world. The emergence of Paris, Dubai, and the UAE as hubs for crypto firms seeking clarity on regulatory rules is a notable development. Additionally, the UK’s efforts to make its regulatory regime for crypto more competitive vis-a-vis the EU’s Markets in Cryptoassets (MiCA) framework is something to keep an eye on.

Impact on Market Growth and Institutional Interest

The evolving regulatory landscape will undoubtedly have an impact on the growth of the crypto market and the level of institutional interest. As regulators around the world work to define their stance on cryptocurrency, it will provide more certainty for institutional investors looking to enter the space. This could potentially lead to an influx of capital into the market and further legitimize cryptocurrencies as an asset class.

Link with NFT Market

Furthermore, the regulatory changes can also have implications for other crypto-related markets, such as non-fungible tokens (NFTs). The future of NFTs in the crypto market is closely tied to regulatory developments, as they continue to gain popularity and attract significant attention from investors and creators alike. For more information on this topic, check out Market for NFTs in the future.

In conclusion, the regulatory landscape for cryptocurrencies is rapidly evolving, with 2024 poised to be a crucial year for shaping up regulations around the world. This will have a direct impact on market growth, institutional interest, and other related markets like NFTs. It’s important to stay informed about these developments as they unfold to understand how they may impact the future of cryptocurrencies.

Bitcoin’s Unique Features and Benefits

Bitcoin, the first and most well-known cryptocurrency, offers a range of unique features and benefits that have contributed to its widespread adoption and popularity. Here are some key aspects that set Bitcoin apart:

Decentralization

- Decentralized Ledger: Bitcoin operates on a decentralized ledger called the blockchain, which is maintained by a network of nodes rather than a central authority. This ensures security, transparency, and resistance to censorship.

- Financial Inclusion: Bitcoin enables individuals in countries with unstable financial systems to access financial services without relying on traditional banks.

Limited Supply

- Scarcity: Unlike traditional currencies that can be printed at will, Bitcoin has a limited supply of 21 million coins, making it an attractive hedge against inflation and currency devaluation.

Security

- Cryptography: Bitcoin transactions are secured using cryptographic techniques, making it extremely difficult for unauthorized parties to alter transaction data or counterfeit bitcoins.

- Ownership Control: Bitcoin users have full control over their funds and can execute transactions without relying on third parties.

Global Accessibility

- Borderless Nature: Bitcoin can be sent and received anywhere in the world without the need for intermediaries or currency conversion fees.

- 24/7 Markets: The cryptocurrency market operates 24/7, providing flexibility and accessibility for traders and investors globally.

Investment Potential

- Store of Value: Many investors view Bitcoin as a digital store of value similar to gold, seeking to diversify their investment portfolios.

- Investment Opportunity: As institutional interest in Bitcoin grows, the cryptocurrency is increasingly being considered as a legitimate investment asset alongside traditional stocks and bonds.

In light of these unique features and benefits, Bitcoin has garnered significant attention from individuals, institutional investors, and regulatory bodies. As the regulatory landscape for cryptocurrencies continues to evolve, it’s essential for market participants to stay informed about the latest developments.

In fact, the European Union’s (EU) Markets in Crypto-assets (MiCA) framework is expected to play a crucial role in shaping the regulatory outlook for crypto. France has emerged as an attractive destination for crypto firms operating under MiCA, with the Autorite des Marches Financiers (AMF) administering a registration framework for businesses offering trading, custody, and other services within France. This development has positioned France as a potential hub for crypto innovation within MiCA’s framework Ethereum vs Bitcoin: which is better.

With growing confidence in the regulatory environment and increasing institutional involvement in the crypto space, it’s clear that Bitcoin’s unique features and benefits will continue to shape the future of the digital asset landscape.

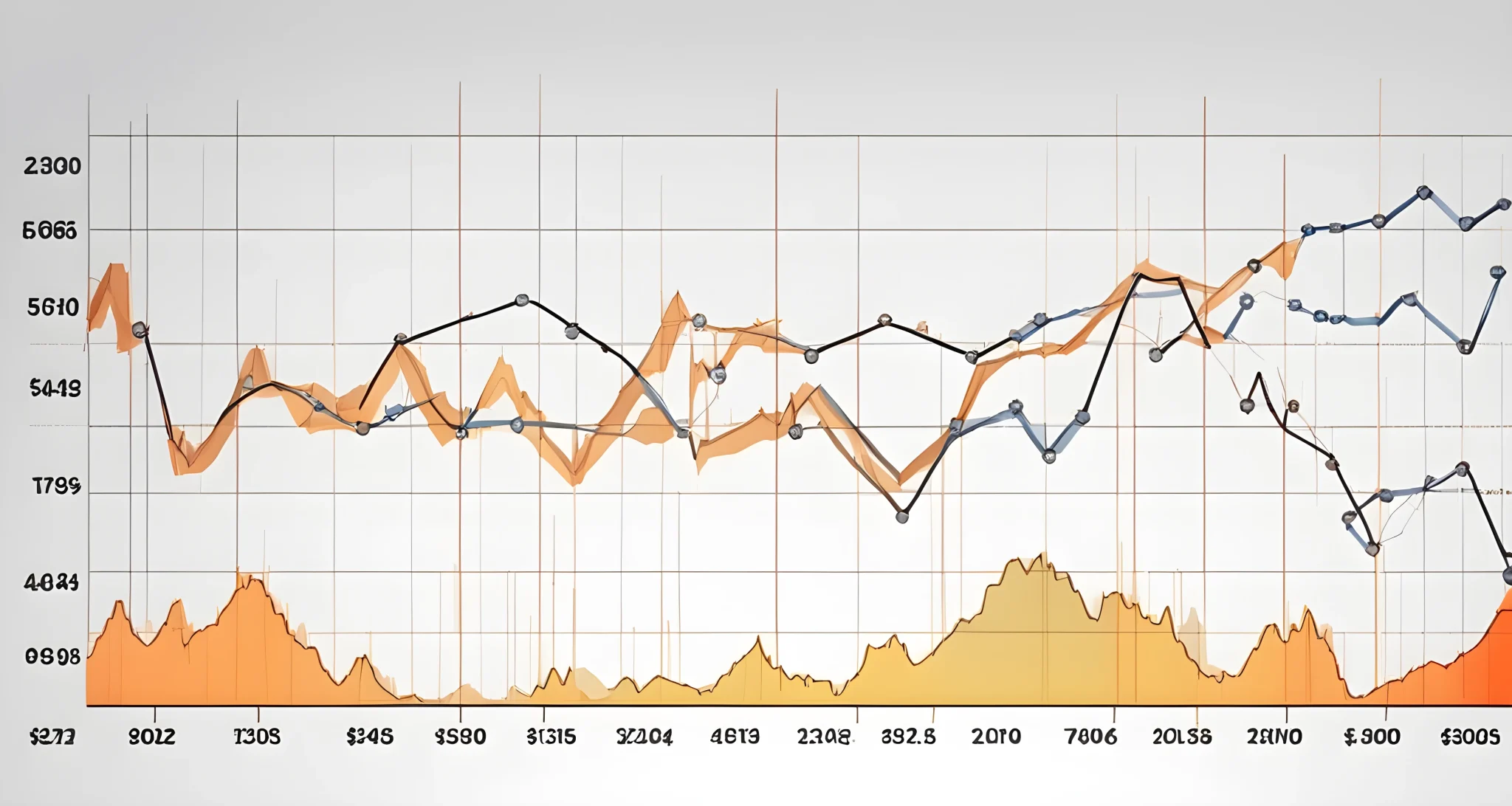

Concerns About Stability

One of the major concerns surrounding the cryptocurrency market is its stability. The volatility of cryptocurrencies like Bitcoin has raised concerns among investors and regulators alike. Here are some of the key concerns about stability in the crypto space:

-

Price Volatility: The value of cryptocurrencies can fluctuate dramatically over short periods of time, leading to concerns about price stability. This volatility can make it difficult for businesses and individuals to use cryptocurrencies as a reliable medium of exchange.

-

Market Manipulation: There have been instances of market manipulation in the crypto space, where large players or whales can influence the price of cryptocurrencies through coordinated buying or selling. This manipulation can further exacerbate price instability and erode investor confidence.

-

Regulatory Uncertainty: The lack of clear and consistent regulations governing the crypto market has also contributed to concerns about stability. Without a well-defined regulatory framework, investors may be hesitant to enter the market, fearing potential legal and compliance risks.

-

Security Risks: The security of cryptocurrency exchanges and wallets has also been a point of concern, with several high-profile hacks and thefts occurring in the past. These security breaches can lead to significant losses for investors and undermine confidence in the overall stability of the market.

Despite these concerns, there are efforts underway to address stability issues in the crypto space. Dubai, for example, has established a robust regulatory framework through its Virtual Assets Regulatory Authority (VARA), providing confidence to firms seeking to invest in this dynamic and growing sector Crypto sentiment outlook analysis.

By addressing these concerns and implementing comprehensive regulatory measures, the crypto industry can work towards achieving greater stability, thereby attracting more institutional interest and fostering long-term growth.

Regulatory Status and Uncertainty

As the crypto space continues to grow and evolve, regulatory status and uncertainty remain a key concern for investors and industry players.

Turkey’s Positioning as a Regional Rival

Turkey is making significant strides in positioning itself as a regional rival to the UAE by pressing ahead with new crypto regulatory frameworks. This move not only signals the country’s commitment to embracing cryptocurrencies but also sets the stage for increased competition in the region.

Africa’s Regulatory Developments

Further afield, important regulatory developments are underway in Africa, with countries such as Nigeria and South Africa making progress in establishing their own crypto regulatory frameworks. This is indicative of the continent’s growing importance in the global crypto landscape.

Impact on Investor Confidence

The regulatory status and uncertainty in various regions have a direct impact on investor confidence and the overall stability of the crypto market. As different countries navigate their own regulatory paths, investors are left to navigate a complex web of rules and guidelines, adding an additional layer of uncertainty to their investment decisions.

Bitcoin’s Unique Position

Despite these challenges, Bitcoin’s unique features and benefits continue to set it apart as a leader in the crypto space. Its decentralized nature and limited supply serve as key selling points for investors looking for stability amidst regulatory uncertainty.

The Role of Institutional Interest

Growth and institutional interest also play a crucial role in shaping the future of crypto regulations. As more institutional players enter the market, there is increasing pressure for clear and comprehensive regulatory frameworks to provide a stable environment for investment.

In conclusion, while regulatory status and uncertainty continue to be key challenges in the crypto space, there are signs of progress and development across different regions. The evolving landscape presents both risks and opportunities for investors, making it essential to stay informed and adaptable in navigating the complexities of crypto regulations.

For more information on investment potential altcoins, check out Investment potential altcoins article.

Growth and Institutional Interest

The cryptocurrency market has experienced significant growth in recent years, with an increasing number of institutions and countries showing interest in this space. This section will explore the important strides made in establishing regulatory frameworks for cryptocurrencies and the growing institutional interest in the crypto space.

Regulatory Frameworks

- Countries and regulatory bodies have been making important strides in establishing their own regulatory frameworks for cryptocurrencies.

- This is a positive development as it brings a level of legitimacy and oversight to the crypto market.

- As the regulatory landscape continues to evolve, it is crucial for investors and market participants to stay informed about the changing regulations.

The Rise of Institutional Interest

- With the evolving regulatory landscape, there is growing interest and investment in the crypto space by institutions.

- Institutions are increasingly recognizing the potential benefits of cryptocurrencies and blockchain technology.

- The Blockchain DeFi progress has played a significant role in attracting institutional interest, as decentralized finance (DeFi) platforms offer innovative and efficient financial services on the Ethereum blockchain.

Adapting to Change

- Institutions and countries are adapting to the changing environment by exploring new opportunities in the crypto space.

- The growing interest from institutions further validates the potential of cryptocurrencies as an asset class and technology.

Investment Trends

- There is a noticeable increase in investment from institutional players, such as hedge funds, asset managers, and family offices.

- This trend indicates a shift in traditional investment strategies towards embracing digital assets.

- The growing institutional interest also reflects confidence in the long-term potential of cryptocurrencies.

Evolving Landscape

- The evolving regulatory landscape, along with growing institutional interest, signifies a maturing crypto market.

- As more institutions enter the space, it is likely to bring greater stability and liquidity to the market.

- This evolution paves the way for wider adoption of cryptocurrencies as viable investment options.

In conclusion, the cryptocurrency market continues to experience significant growth, with institutions and countries taking important steps to establish regulatory frameworks. The rise of decentralized finance on the Ethereum blockchain has contributed to growing institutional interest in the crypto space. As the landscape continues to evolve, it is essential for investors and market participants to stay informed about these trends.

FAQ

What are some emerging hubs for crypto firms seeking regulatory clarity?

Paris, dubai, and the uae are emerging as hubs for crypto firms seeking clarity on regulatory rules, with france and the uae implementing registration frameworks for businesses offering trading, custody, and other services, and dubai hosting the world’s first crypto-specific supervisor, the virtual assets regulatory authority (vara).

What role is the eu’s mica framework expected to play in shaping the regulatory outlook for crypto?

The eu’s mica framework is expected to play a crucial role in shaping the regulatory outlook for crypto, with france becoming a sought-after destination for crypto firms under mica and the uk making efforts to make its regulatory regime for crypto more competitive vis-a-vis the eu’s mica framework.

Which countries in africa are making significant strides in crypto regulatory developments?

Nigeria and south africa are making significant strides in crypto regulatory developments, with both countries working on implementing new regulatory frameworks for the crypto space.

What recent regulatory developments are happening in turkey?

Turkey is making significant strides in positioning itself as a regional rival to the uae by pressing ahead with new crypto regulatory frameworks, indicating growing interest and activity in the crypto space in the region.